Investing in your company can increase cash flow and profitability. Additionally, it can help you gain new equipment, R&D help, or additional staff. Learn the QuickBooks owner capital steps. To keep correct company accounting, you must register and track your and your business partner’s capital investments. QuickBooks customers can use the Make Deposit option to report the Owner’s capital investment. It adds the necessary asset to Owner’s equity.

What exactly is the term “Owner’s Capital” in QuickBooks?

In other words, the Owner’s capital consists of profits, investments, and additional cash. The Owner’s wealth includes retained earnings. When registering the Owner’s money, you can use an Owner’s equity account to track transactions. Use the Owner’s draw account to report transactions involving general business assets. Keeping the Owner’s financial information and the firm’s public finances in different locations simplifies tax preparation and income and expenditure tracking.

The Step-by-Step Guide to Recording Owner Capital in QuickBooks

QuickBooks’ desktop version, QuickBooks Desktop, is the one that registers owner contributions. You only have to open an equity account and then deposit the money into it. If you decide to return the investment provided, you can do it very effortlessly in QuickBooks. This lesson will teach us how to record specific owner contributions in QuickBooks through a series of thorough processes.

1). Create an account for the Owner’s equity.

You need to have a specific equity account in place before you can register the donation made by the Owner.

Step 1: To access the QuickBooks Settings, select the Gear icon in the screen’s upper-right corner.

Step 2: You will see a menu where you can select the Chart of Accounts option.

Step 3: At this point, select the “new” button.

Step 4: you will choose the Account type option to select the Owner’s equity option.

Step 5: From the drop-down menu presented to you, select the option Detail Type to choose either the Owner’s equity or the Partner’s equity.

Step 6: When you are finished, select the Save and Close the window option.

After these particulars and particulars have been preserved, you will be given an equity account. You cannot record the gift made by the Owner in this specific account.

2) Recording the Owner’s Contribution to the Organization

You can choose between two choices to record the financial contribution made by the Owner. You can either navigate to the Chart of Accounts or create Bank Deposits. Continue reading to find out the several methods by which the contribution of the Owner can be registered in QuickBooks.

Alternative 1:

Step 1: Go to the menu, find the Accounting option, and then click on it.

Step 2: Choose the menu item labelled “Chart of Accounts.”

Step 3: Select New from the drop-down menu.

Step 4: Once you have reached the Account Type drop-down menu, go to the next step. You have the opportunity to pick the Equity option.

Step 5: When this is finished, navigate to the Detail Type drop-down menu and select the Owner Equity option from the list of available choices.

Step 6: Select the Owner’s Contribution option from the drop-down menu after locating the Name box.

Step 7: In the space designated for the Balance, enter the specific amount representing the Owner’s contribution.

Step 8: When all of this is finished, use the option to Save and Close the file.

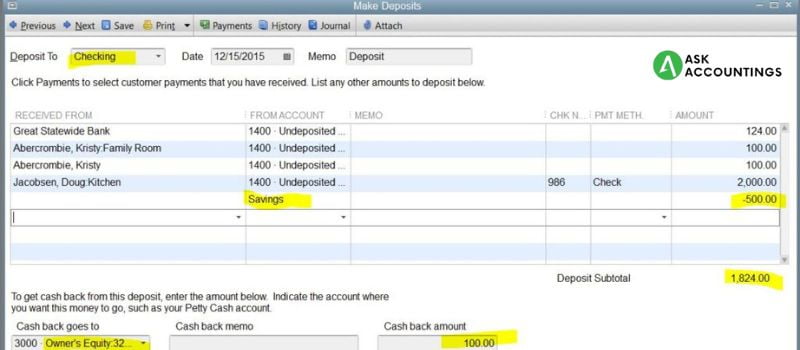

Alternative 2

Step 1: On the left-hand side of the screen, select the option labelled “+ New.”

Step 2: At this point, you need to press the button labelled “Bank Deposit.”

Step 3: Select the account to which the specified amount will be deposited by pressing the arrow on the drop-down menu next to the Account option.

Step 4: Proceed to the Date area and add the date you said the specific amount by going there now.

Step 5: Find the option that reads “Add funds to this deposit” and clicks on it. Fill in the investor’s name in the specific field that asks for it, and it will indicate Received From.

Step 6: You can select the Equity Account by going to the Account drop-down menu and clicking the corresponding button.

Step 7: When everything is finished, you will have the opportunity to add the Payment Method.

Step 8: You will notice a section labelled “Amount.” It is where you will add the amount of money into the investment.

Step 9: At this point, you can press the button labelled “Save and Close.”

In most cases, the Owner’s capital or capital investment is the fund used to accomplish particular firm objectives, such as purchasing vehicles, machinery, and other things.

What are the advantages of keeping track of owner investments with QuickBooks?

The key advantages of using QuickBooks to keep track of owner investments include the following: The following are some of these benefits:

- Since the money from the investment has been recorded in the QuickBooks account, you can view it whenever you like.

- You can tell when the Owner or a particular partner has contributed the designated amount of equity to the company.

- Through the equity account, you can keep track of the investment.

- There is the potential for additional equity accounts to be added to the primary equity account in the form of sub-accounts.

Conclusion

Keeping an eye on who takes money out and who contributes new funds is essential. Because of this, you must keep a record of the Owner’s donation. A gift of this kind may also come from friends, coworkers, business partners, etc. In this post, we have made an effort to clarify everything regarding the recording of the Owner’s capital in QuickBooks that is required to have an understanding. You can, however, contact Dancing Numbers Experts via LIVE CHAT if you are still trying to go further in the game and seek assistance from a trained specialist. If you need help registering the Owner’s capital in QuickBooks, our trained staff members can provide it.

Also Read:- How to Upgrade From QuickBooks 2013 to 2016

Also Read:- Lowes Synchrony Bank Card Login Issue